- Tingkat kelintar

- Churn rate

- Customer attrition

- Customer lifetime value

- Office space planning

- Churn

- Digital adoption platform

- Customer relationship management

- DHCP churn

- Instance dungeon

- Share of wallet

- Churn Rate: What It Means, Examples, and Calculations - Investopedia

- Churn Rate | Definition, Types, Calculation, Reduction Strategies

- What Is Churn Rate & How Do You Calculate It? - Forbes

- Churn rate - Wikipedia

- How to Calculate Churn Rate in 5 Easy Steps [Definition + Formula]

- Churn Rate Formula: How to Calculate and Analyze Churn

- Churn rate: What it is + how to calculate it - Zendesk

- What is churn rate? Formula, definition, and how to reduce churn

- Churn Rate: What It Means, How To Calculate It And 3 …

- Churn Rate - Definition, Types of Churn Rates, and Importance

churn rate

Video: churn rate

Churn rate GudangMovies21 Rebahinxxi LK21

Churn rate (also known as attrition rate, turnover, customer turnover, or customer defection) is a measure of the proportion of individuals or items moving out of a group over a specific period. It is one of two primary factors that determine the steady-state level of customers a business will support.

Churn is widely applied in business for contractual customer bases. Examples include a subscriber-based service model as used by mobile telephone networks and pay TV operators. Churn rate can also be the input into customer lifetime value modeling and used to measure return on marketing investment with marketing mix modeling. The term comes from the image of agitation of cream in a butter churn.

Calculation

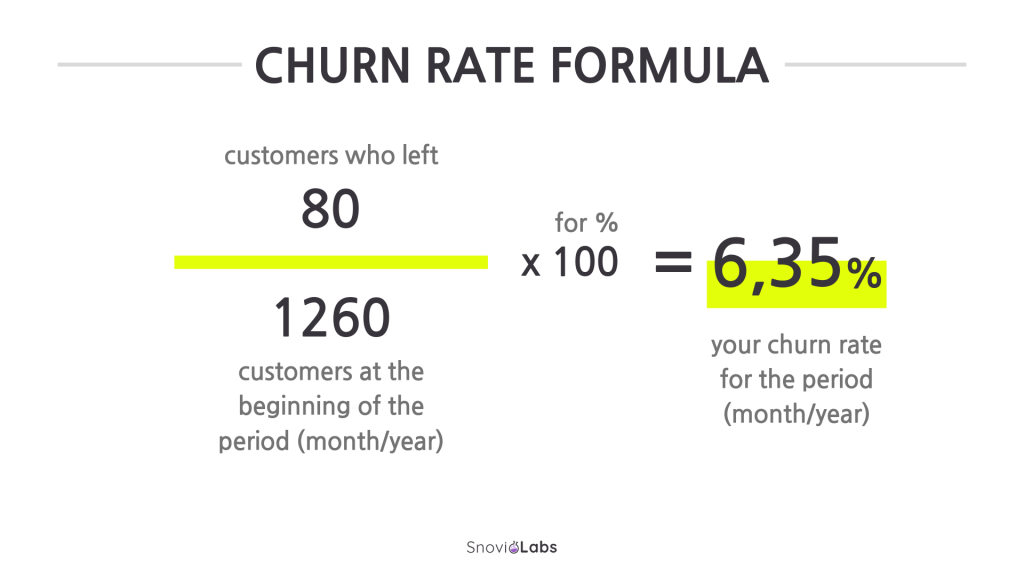

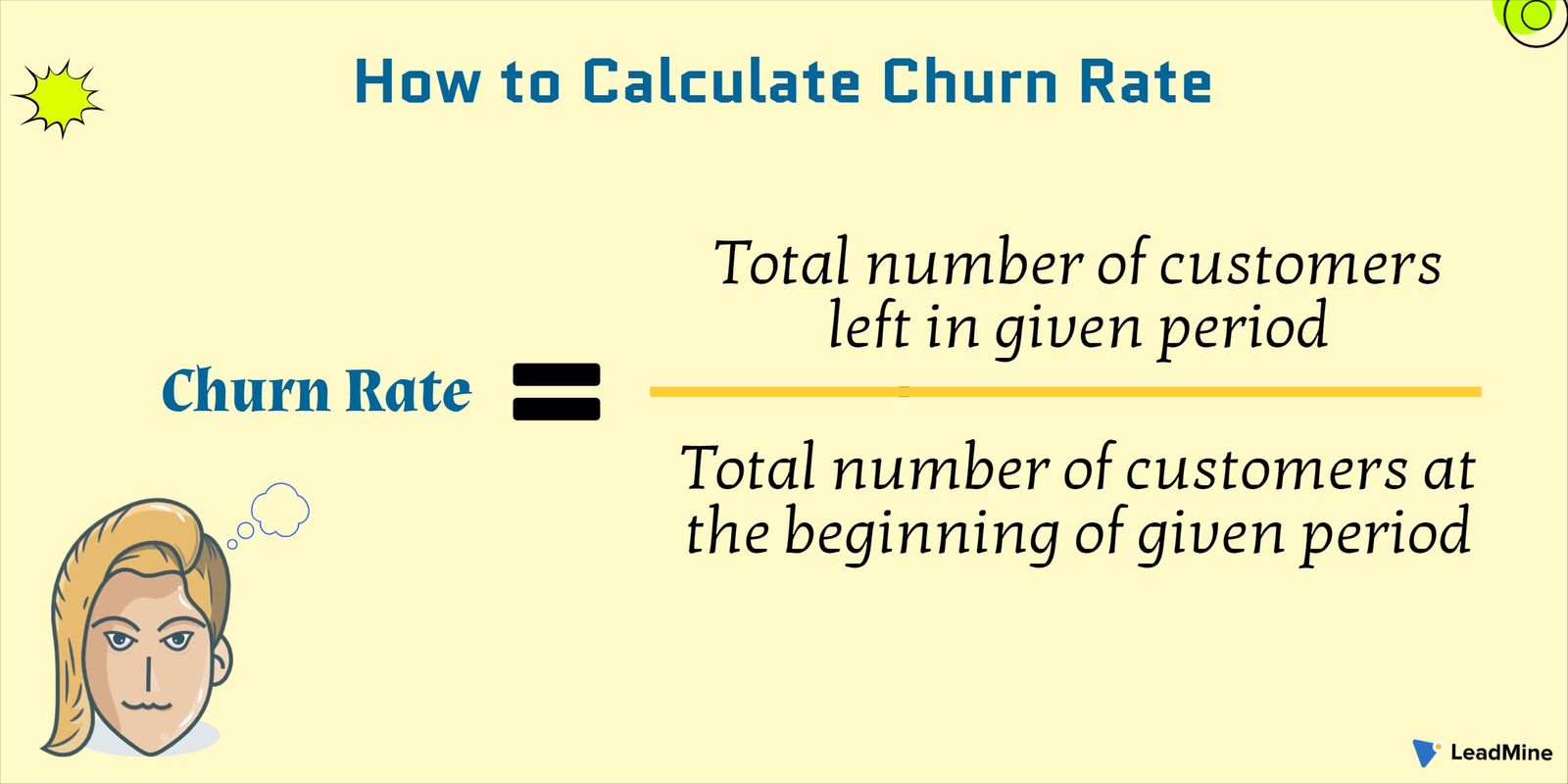

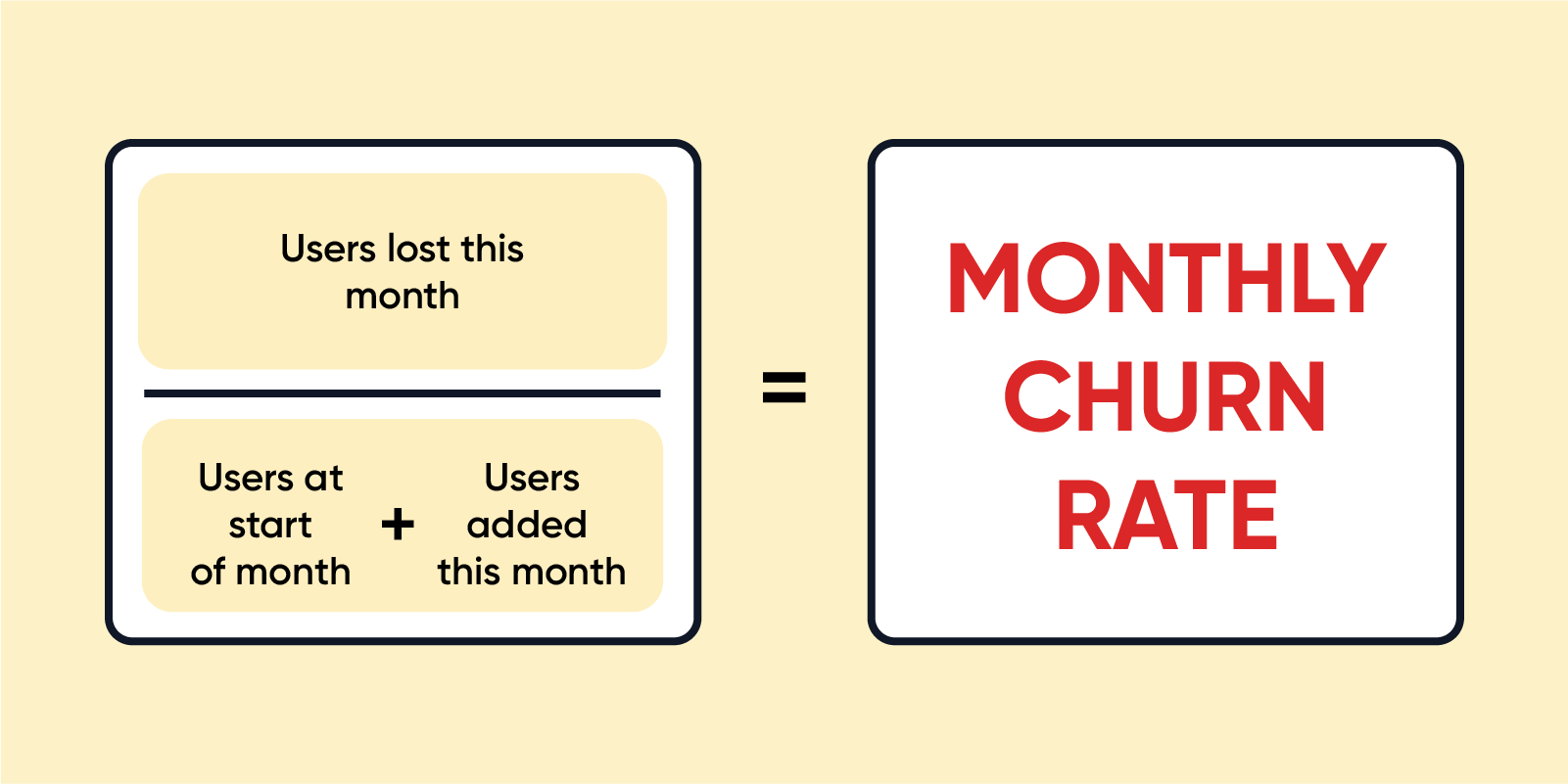

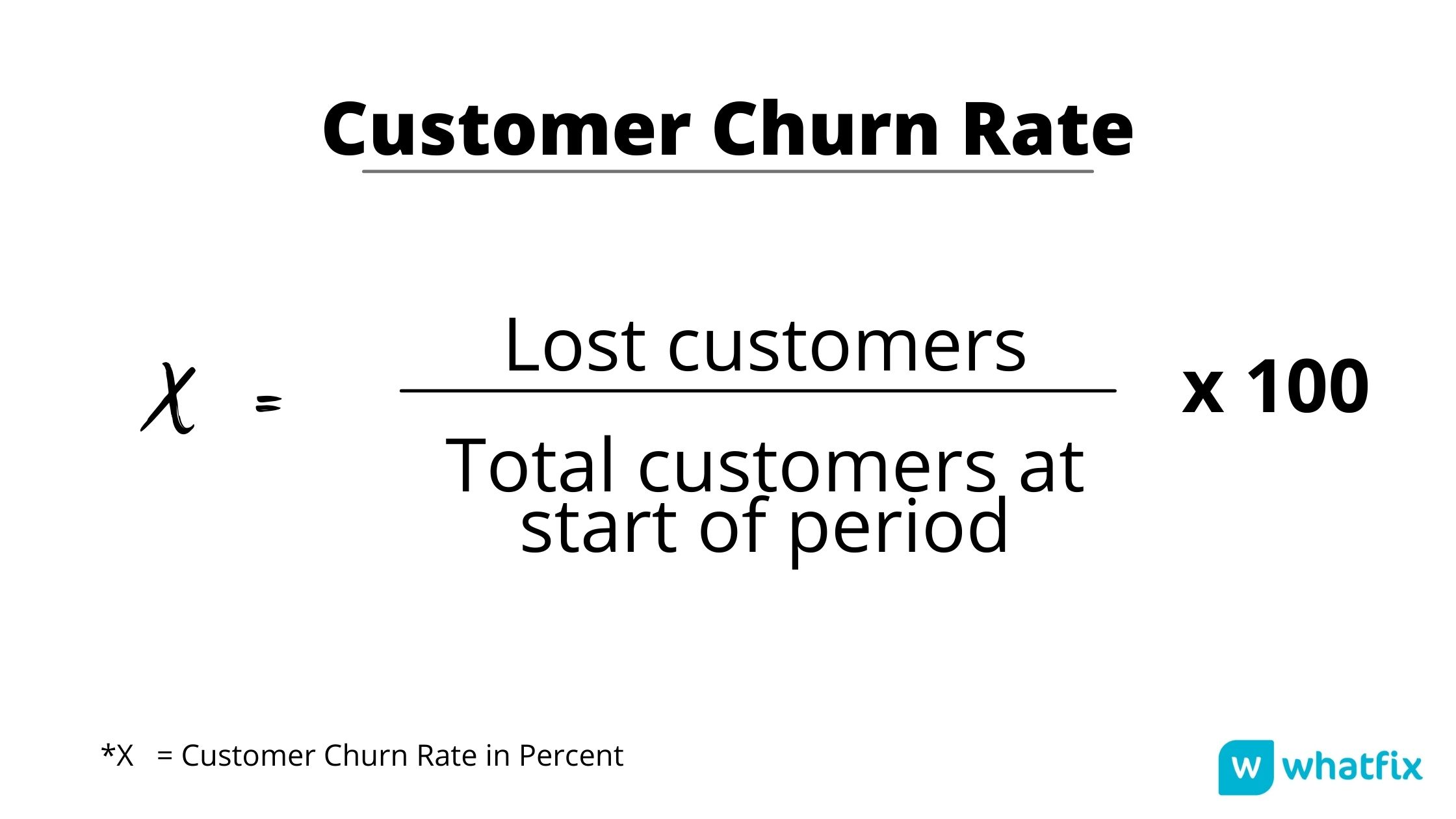

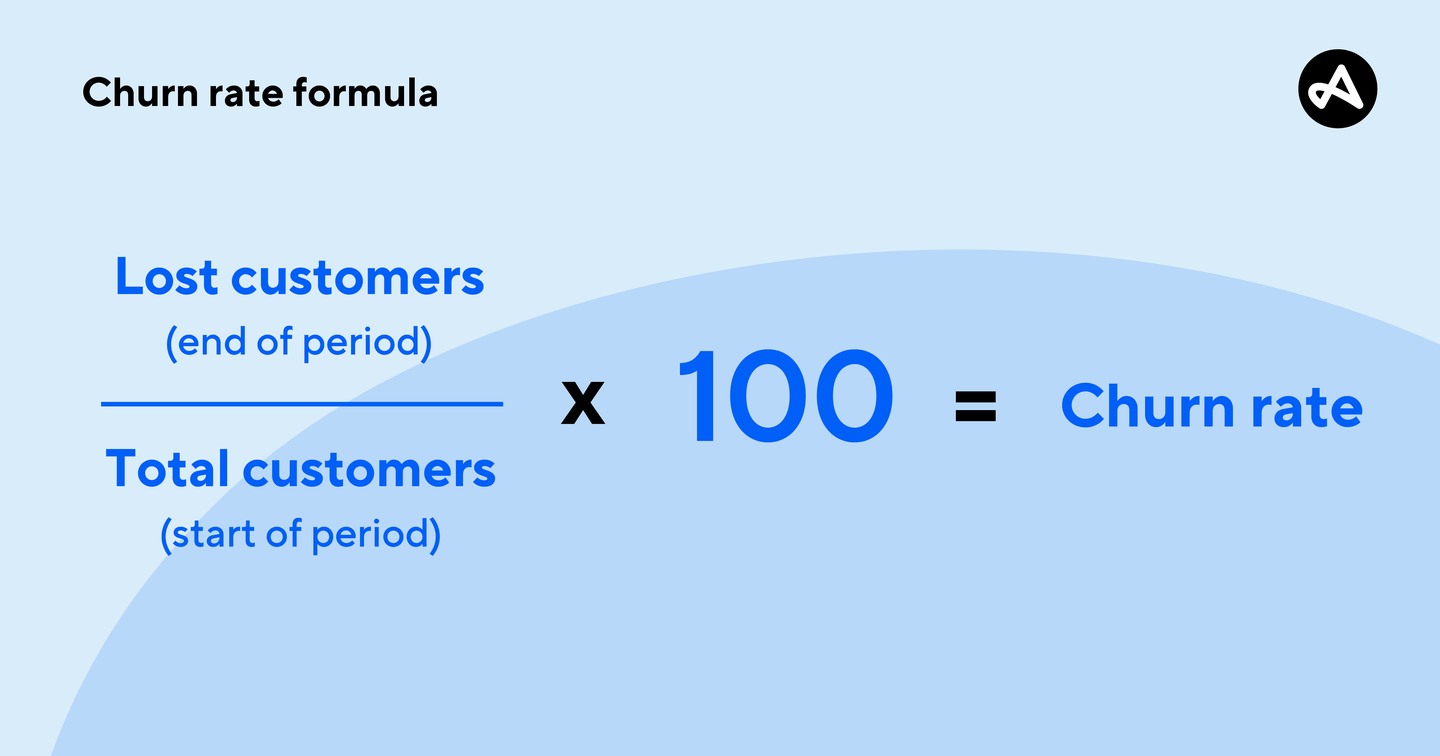

Churn rate is calculated by dividing the total number of individuals, customers, or items lost during a period divided by total number of individuals during the same period.

Churn

=

L

T

∗

100

=

Customers lost

Total customers during time period

∗

100

{\displaystyle {\text{Churn}}={\frac {L}{T}}*100={\frac {\text{Customers lost}}{\text{Total customers during time period}}}*100}

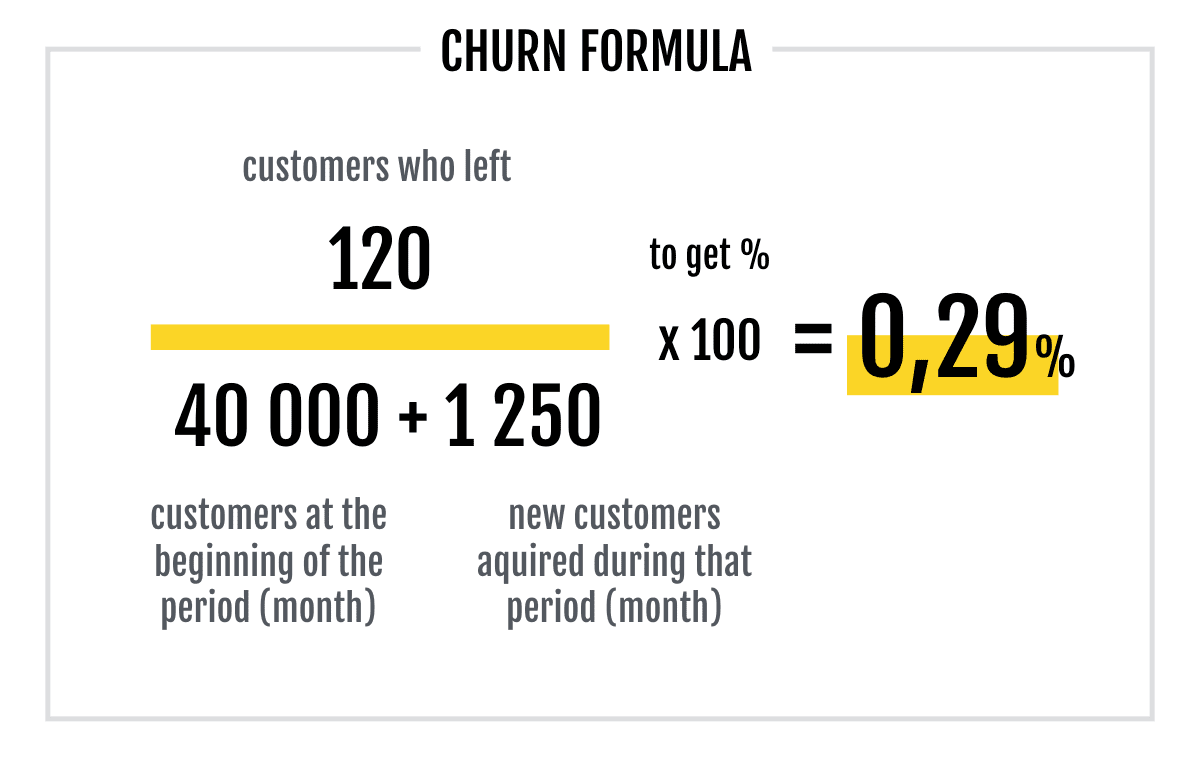

For example, if your company lost 50 customers in month, while having a total of 500 customers at the start of the month, the total churn rate is 10% (50/500*100 = 10%).

An alternative calculation for churn is to divide by the number of customers acquired during the same time period, rather than total number of customers.

Customer base churn

Churn rate, when applied to a customer base, is the proportion of contractual customers or subscribers who leave a supplier during a given period. It may indicate of customer dissatisfaction, cheaper and/or better offers from the competition, more successful sales and/or marketing by the competition, or reasons having to do with the customer life cycle.

Churn is closely related to the concept of average customer life time. For example, an annual churn rate of 25 percent implies an average customer life of four years. An annual churn rate of 33 percent implies an average customer life of three years. The churn rate can be minimized by creating barriers which discourage customers to change suppliers (contractual binding periods, use of proprietary technology, value-added services, unique business models, etc.), or through retention activities such as loyalty programs. It is possible to overstate the churn rate, as when a consumer drops the service but then restarts it within the same year. Thus, a clear distinction needs to be made between "gross churn", the total number of absolute disconnections, and "net churn", the overall loss of subscribers or members. The difference between the two measures is the number of new subscribers or members that have joined during the same period. Suppliers may find that if they offer a loss-leader "introductory special", it can lead to a higher churn rate and subscriber abuse, as some subscribers will sign on, let the service lapse, then sign on again to take continuous advantage of current specials.

When talking about subscribers or customers, sometimes the expression "survival rate" is used to mean 1 minus the churn rate. For example, for a group of subscribers, an annual churn rate of 25 percent is the same as an annual survival rate of 75 percent. Both imply a customer lifetime of four years because a customer lifetime can be calculated as the inverse of that customer's predicted churn rate. For a group or segment of customers, their customer life (or tenure) is the inverse of their aggregate churn rate. Gompertz distribution models of distribution of customer life times can therefore also predict a distribution of churn rates.

For companies with a fast-growing customer base (e.g., digital media companies in a BCG-matrix problem child or star phase), confusion can arise between the statistical analyses associated with what percentage of the whole customer base churns in a given year – What percentage of the base of subscribers in all of 2010 churned out? – versus a particular customer cohort's churn rate.

For example: Taking those customers who subscribed in given month, say January 2010 – How many had churned out by January 2011?

Examining churn for a fast-growing aggregated customer base will understate the true churn rate compared to cohort based approach to the calculation.

The cohort based approach will also allow you to calculate the survival rate and the average customer life, whereas the aggregate approach can not calculate these two metrics.

Researchers at Deloitte have argued that social network analysis is a good tool to calculate churn.

In recent years, using AI and machine-learning as a means to calculate customer churn has become increasingly common for large retailers and service providers.

The phrase "rotational churn" is used to describe the phenomenon where a customer churns and immediately rejoins. This is common in prepaid mobile phone services, where existing customers may take up a new subscription from their current provider in order to avail of special offers only available to new customers.

In most circumstances churn is seen as indicating that customers are dissatisfied with a service. However, in some industries whose services delivers on a promise, churn is considered as a positive signal, such as the health care services, weight loss services and online dating platforms.

Some researchers have disputed the simple assumption that just dissatisfaction would lead customers to churn, and called for a more nuanced approach.

See also

Turnover (employment)

Customer attrition

Customer retention

References

Further reading

Berry and Linoff, Michael J.A. and Gordon S. (2000). Mastering Data Mining: The Art and Science of Customer Relationship Management. John Wiley & Sons. ISBN 0-471-33123-6.

Cached Insight paper on churn in the mobile communications industry.

Kata Kunci Pencarian: churn rate

churn rate

Daftar Isi

Churn Rate: What It Means, Examples, and Calculations - Investopedia

Mar 21, 2024 · What Is the Churn Rate? The churn rate, also known as the rate of attrition or customer churn, is the rate at which customers stop doing business with an entity. It is most commonly...

Churn Rate | Definition, Types, Calculation, Reduction Strategies

Sep 7, 2023 · Churn rate, also known as attrition rate, refers to the percentage of subscribers to a service who discontinue their subscriptions within a given time period. For a company to grow its client base, its growth rate (i.e., its new customers) must exceed its churn rate.

What Is Churn Rate & How Do You Calculate It? - Forbes

Jun 10, 2024 · The churn rate refers to the rate at which subscribers or customers stop transacting with your business. Simply put, they are subscribers who canceled their subscriptions...

Churn rate - Wikipedia

Churn rate, when applied to a customer base, is the proportion of contractual customers or subscribers who leave a supplier during a given period. It may indicate of customer dissatisfaction, cheaper and/or better offers from the competition, more successful sales and/or marketing by the competition, or reasons having to do with the customer ...

How to Calculate Churn Rate in 5 Easy Steps [Definition + Formula]

Jan 15, 2018 · What is churn rate, and how do you calculate it? Learn about customer churn rate and revenue churn rate, and why they are important metrics to measure.

Churn Rate Formula: How to Calculate and Analyze Churn

Mar 15, 2024 · Learn how to define and calculate churn to improve customer retention. The formula for customer churn rate is (the number of customers lost during a period / the number of customers at the start of the period) x 100.

Churn rate: What it is + how to calculate it - Zendesk

Mar 27, 2024 · Customer churn rate is the percentage of customers that stop doing business with a company over a designated time frame. Learn more about it in our guide.

What is churn rate? Formula, definition, and how to reduce churn

Apr 10, 2023 · Churning, in business terms, refers to the high rate of customer turnover or the process of losing customers and gaining new ones over a given period of time, often resulting from a lack of customer satisfaction, poor customer service, or competition from other companies.

Churn Rate: What It Means, How To Calculate It And 3 …

Jan 21, 2025 · Churn Rate indicates the rate at which you involuntarily lose customers, pointing to potential areas for improvement. It’s calculated by dividing the number of customers lost by the total number of customers, then multiplying by 100. A low churn rate equals a stable customer base and ongoing growth.

Churn Rate - Definition, Types of Churn Rates, and Importance

Churn rate, also referred to as attrition rate, measures the number of individuals or units leaving a group over a specified time period. The term is used in many contexts, including in business, human resources, and IT.