- Source: Factor theory

In finance, factor theory is a collection of related mathematical models that explain asset returns as driven by distinct economic risks called factors. In less formal usage, a factor is simply an attribute or collection of related attributes that explain an asset's returns.

The original factor model is the capital asset pricing model (CAPM), which predicts that an asset's expected return in excess of the risk-free rate is wholly determined by its exposure to the market factor. More formally, an asset's expected excess return is linearly related its co-movement with the market portfolio.

The most famous extension to the CAPM is the Fama–French three-factor model, which adds size and value factors to explain the cross-sectional returns of stocks. This extension was made due to the empirical failure of the CAPM.

See also

Capital asset pricing model

Fama-French three-factor model

Carhart four-factor model

Kata Kunci Pencarian:

- Critical success factor

- Teori Schumpeter

- Teori tumbukan

- Fungsionalisme struktural

- Hebefilia

- Tujuan

- Indonesian Idol

- Mazhab Austria

- Britania Raya

- Teori informasi

- Two-factor theory

- Two-factor theory of intelligence

- Two-factor theory of emotion

- Factor theory

- Common factors theory

- Operant conditioning

- Emotion

- Motivation

- Situational leadership theory

- Factor

- 1

- 2

The Mad Adventures of Rabbi Jacob (1973)

maboroshi (2023)

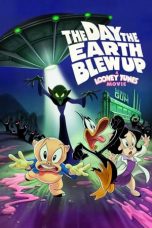

The Day the Earth Blew Up: A Looney Tunes Movie (2024)

No More Posts Available.

No more pages to load.