- Balyasny Asset Management

- List of hedge funds

- Jain Global

- S.A.C. Capital Advisors

- Lisa Wang

- Qualified Foreign Institutional Investor

- Got Your 6

- About BAM - Global Investment Firm | Balyasny Asset Management

- Balyasny Asset Management - Wikipedia

- Investment Philosophy and Strategies | Balyasny …

- Balyasny Asset Management L.P. | LinkedIn

- BALYASNY ASSET MANAGEMENT L.P. Top 13F Holdings

- Balyasny Asset Management Fund Performance History

- Balyasny Asset Management reviews - Glassdoor

- Balyasny Asset Management - Wikipedia

- Capital AUM | Balyasny Asset Management Overview

Jolt (2021)

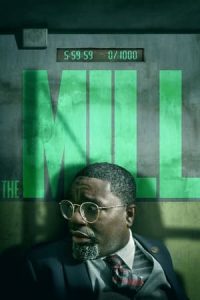

The Mill (2023)

Red Sparrow (2018)

Balyasny Asset Management GudangMovies21 Rebahinxxi LK21

Balyasny Asset Management is an American investment management firm headquartered in Chicago. Outside the U.S., it has additional offices in Canada, London, and Asia.

Background

Balyasny Asset Management was founded in 2001 in Chicago by Dmitry Balyasny, Scott Schroeder and Taylor O'Malley. It traded mostly long/short equity which, as of 2020, accounted for 70% of the firm's risk.

For the first 16 years of its existence, it rarely lost money and delivered an annualized return of 12%.

However, in 2018, the firm experienced unprecedented significant difficulty, posting large performance losses, its assets under management dropping by half from $12 billion to $6 billion and client investors withdrawing their money from the firm. Balyasny himself sent out an email to the firm's staff with the subject line "Adapt or Die" that bluntly stated that "we are getting our butts kicked" and the firm's performance "sucks". In the email he also stated he didn't feel a "palpable sense of urgency" on the trading floor and mentioned that investors were wondering if staff joined the firm "so they can enjoy not working too hard". This email wound up in the hands of Kenneth C. Griffin, the founder and CEO of Citadel LLC. Balyasny Asset Management and Citadel LLC were hedge fund rivals as they were both based in Chicago at the time and spent a lot of money in a talent war where they would both try to poach each other's employees. Griffin used this email in an internal town hall meeting for employees, telling them this was an example of what happens when a firm has poor culture. Balyasny Asset Management then cut 125 jobs which was around 20% of the firm's workforce. Balyasny has stated the mistakes in 2018 were caused by undue caution and a tough environment for long/short equity.

Since then, the firm underwent some significant changes including hiring a lot of new staff, changing the firm's risk management approach and transitioned to having more institutional investors as clients rather than high-net-worth individuals. By 2019, the firm was back into profitability.

In February 2022, Balyasny stated the firm has been investing in private startups, a trend done by other hedge fund peers such as Tiger Global Management and Coatue Management.

In March 2022, the firm announced it would create a new equities unit called Corbets Capital with offices in New York and Greenwich, Connecticut.

In May 2022, the firm had $15.7 billion assets under management and 1,100 employees which include 470 investment professionals. As of August 2023, the firm had $21 billion assets under management.

In 2023, Balyasny opened an office in Dubai. That same year, the firm switched to longer "lock-ups" for investors' capital, ensuring a minimum of two years for withdrawals.

In June 2023, the firm released its own version of ChatGPT to its employees, and in January 2024, it was reported that the hedge fund was building an AI equivalent of a senior analyst.

In December 2023, the company said that more than half its assets under management were diversified into strategies including early stage investing, commodities, and macro. In 2023 and 2024, the firm added new partners. As of March 2024, it had 23 partners.

Insider trading

In November 2009, Balyasny Asset Management ran an internal investigation focused on a former analyst at the firm who was suspected of passing on insider information about EMC Corporation to a hedge fund manager who pleaded guilty in the Galleon Group case. The firm sent a letter to investors reassuring them that no improper activity had been discovered, and that it had decided to close the satellite office and terminate the individual involved. In 2010, it was reported that Balyasny Asset Management had been added to a group of firms being examined in a wide-ranging investigation into insider trading led by the government, relating to the Galleon case.

Mark Adams, an analyst at the firm, was suspected of passing on insider information about EMC Corporation to Steven Fortuna, a money manager who pled guilty in the Galleon Group case.

References

External links

Official website

Kata Kunci Pencarian:

Balyasny Asset Management – Qwest Contracting

Balyasny Asset Management — Innovant

Balyasny Asset Management - Wikiwand

Balyasny Asset Management | The Org

Balyasny Asset Management - Whois - xwhos.com

Balyasny Asset Management - Optima Asia

Balyasny Asset Management - Optima Asia

Balyasny Asset Management - Optima Asia

Balyasny supercharges productivity by switching from ServiceNow to ...

Balyasny Asset Management NYC — Valerio Dewalt Train

Balyasny Asset Management NYC — Valerio Dewalt Train

Balyasny Asset Management NYC — Valerio Dewalt Train

balyasny asset management

Daftar Isi

About BAM - Global Investment Firm | Balyasny Asset Management

Aug 23, 2017 · BAM is a diversified global investment firm founded in 2001 by Dmitry Balyasny, Scott Schroeder, and Taylor O'Malley. With over $20 billion in assets under management, …

Balyasny Asset Management - Wikipedia

Balyasny Asset Management is an American investment management firm headquartered in Chicago. Outside the U.S., it has additional offices in Canada, London, and Asia.

Investment Philosophy and Strategies | Balyasny …

Feb 22, 2024 · BAM is a leading investment platform that seeks to deliver consistent uncorrelated returns to its investors in all market environments. It employs a multi-strategy, multi-PM model with a blend of core strategies: …

Balyasny Asset Management L.P. | LinkedIn

Learn about Balyasny Asset Management, a global investment firm with over $21 billion in assets and five strategies. See their company size, locations, employees, updates, and awards on LinkedIn.

BALYASNY ASSET MANAGEMENT L.P. Top 13F Holdings

Balyasny Asset Management is a hedge fund with 37 clients and discretionary assets under management (AUM) of $248,044,764,038 (Form ADV from 2025-01-15). Their last reported …

Balyasny Asset Management Fund Performance History

Historical performance of Balyasny Asset Management, showing the return on investment of the portfolio managed by Dmitry Balyasny and comparing it to other hedge funds.

Balyasny Asset Management reviews - Glassdoor

Balyasny Asset Management has an overall rating of 4.3 out of 5, based on over 247 reviews left anonymously by employees. 79% of employees would recommend working at Balyasny Asset Management to a friend and 65% …

Balyasny Asset Management - Wikipedia

Balyasny Asset Management, fondata nel 2001 a Chicago da Dmitry Balyasny, Scott Schroeder e Taylor O'Malley, [3] [4] [5] ha negoziato principalmente azioni long/short che, a partire dal …

Capital AUM | Balyasny Asset Management Overview

Balyasny Asset Management is a Chicago-based hedge fund firm with $265.4 billion in AUM and 25 funds. It employs a multi-strategy approach, investing in various assets and markets …