- Euro

- Euro Truck Simulator 2

- Mata uang global

- INews

- Kejuaraan Eropa UEFA 2024

- Tether

- Uang elektronik

- Tangga lagu Billboard

- Euro Truck Simulator

- Alan Walker

- Digital euro

- Enlargement of the eurozone

- Euro

- EURO STOXX 50

- Central bank digital currency

- History of central bank digital currencies by country

- Digital renminbi

- UEFA Euro 2016

- Cryptocurrencies in Europe

- Euro banknotes

- EU unveils plans for digital euro, promising complete privacy

- Tallinn tales: Estonia’s role in developing the digital euro

- What is digital sovereignty and how are countries approaching it?

- Attack versus defence: central bank digital currencies and ...

- European Central Bank ponders digital currency launch

- Indian government to publish ‘health of civil services’ report

- What's next for the US dollar? Economists discuss at Davos

- Central bank digital currencies: Here's the economic effects

- Has China released a digital currency? | World Economic Forum

- ECB launches SupTech procurement - Global Government Forum

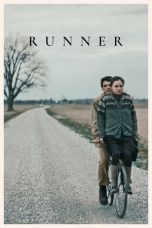

Space Jam: A New Legacy (2021)

Money Electric: The Bitcoin Mystery (2024)

Leaving D.C. (2013)

Digital euro GudangMovies21 Rebahinxxi LK21

The Digital Euro is the project of the European Central Bank (ECB), decided in July 2021, for the possible introduction of a central bank digital currency (CBDC). The aim is to develop a fast and secure electronic payment instrument that would complement the Euro for individuals and businesses in its existing form as cash and in bank accounts, and would be issued by the European System of Central Banks of the Eurozone.

After concluding a two-year investigation into the design and distribution models for a digital euro, the ECB decided on 18 October 2023 to enter the preparation phase, which involves tasks such as finalizing the rulebook and selecting providers to develop the required platform and infrastructure, setting the stage for the potential issuance of a digital euro.

Arguments and motivations for introducing a digital euro

Arguments and motives for the introduction of a digital euro are, according to the ECB:

Preserving central bank money's role as a monetary anchor for the payment system.

Provide free digital access to a secure legal tender in the Eurozone

Expanding payment options through alternative central bank money alongside cash and book money in commercial bank accounts, contributing to availability and inclusion

Building trust in digital cash through a high level of privacy protection

Promote innovation in retail payments

Limiting the spread of foreign digital currencies to safeguard the financial stability and monetary sovereignty of the Eurozone

Programmability would allow targeted incentives to encourage social responsibility and discourage antisocial spending

Wealth redistribution and social aid would be greatly simplified.

In addition to these motives, the possibility of a further decline in the use of cash as a means of payment plays a role in the discussion on the digital euro.

Criticism and risks of the digital euro

Increased centralisation and central planning of monetary policy

Loss of privacy

Risk of financial censorship and loss of human rights

Hacking and information security issues

Higher risks of loss of central bank independence and political influence on monetary policy

Potential for much faster transmission of bad monetary policy

Risks to banking system of bank runs towards CBDC

Distribution fairness issues (Cantillon effect)

Higher political control of individual spending and saving

Weakened Property Rights

While Christine Lagarde has publicly addressed some of these risks, critics consider her responses inadequate. Critics point to the digital Renminbi CBDC and how it has experimented with many of the right-restricting features (including geo-fencing, geo-tracking, amount limits, time limits, etc). They also point to the e-naira and venezuelan Petro and their monetary policy issues. Similarly de-banking issues and financial censorship have been on the rise in recent years, critics fear that a centrally planned, centrally controlled and managed system would have the potential for a much higher level of censorship and discrimination by authorities.

The prototype developed by the ECB as part of the investigation phase includes conditional payments, this points to the potential for programmability of the digital euro and thus similar risks to individual rights as in the digital renminbi.

According to the Human Rights Foundation, CBDCs risk imposing sweeping financial surveillance, restriction of financial activity, frozen funds, seizure of funds, negative interest rates, tools for corruption, cyberattack risks and disruptions to financial stability.

Preparations for the possible introduction of a digital euro

On 2 October 2020, the ECB published a report outlining the introduction of a digital euro from the perspective of the Eurosystem.

Since 2020, several projects have been launched in collaboration with the European Investment Bank (EIB) to test the issuance, control and transfer of central bank digital currency, as well as securities tokens and smart contracts on a blockchain.

= 2021

=After preliminary planning and presenting public consultation results in early 2021, the ECB launched the digital euro project in July 2021 to prepare for its potential introduction. No technical barriers were identified during the preliminary planning. The research, which is scheduled to run until autumn 2023, aims to shed light on the distribution to merchants and citizens, the impact on markets and the necessary European legislation. No preliminary decision has therefore been taken on the introduction of the digital euro.

= 2022

=In September 2022, the ECB announces a collaboration with five companies (Amazon, CaixaBank, Worldline, EPI and Nexi) to develop potential user interfaces for the digital euro.

Burkhard Balz, a member of the Bundesbank's Executive Board, sees the digital euro not least as a means of strengthening European sovereignty in payments. In his view, the digital euro could be designed to support programmable payments in a highly automated environment.

The first "Progress on the investigation phase of a digital euro" report was published by the ECB in September 2022.

Speaking at the conference "Towards a legislative framework enabling a digital euro for citizens and businesses" held in Brussels in early November 2022, Christine Lagarde, President of the European Central Bank, reiterated that the digital euro is not a stand-alone project limited to the area of payments. Rather, it is a cross-policy and truly European initiative that has the potential to have an impact on society as a whole.

In December 2022, the ECB published the second progress report on the investigation phase.

= 2023

=In January 2023, the ECB invited experts in the field of payments/finance to express their interest in contributing to the development of a set of rules for the digital euro.

At the end of May 2023, the ECB published the results of a market research and prototyping project. The market research had shown that there was a sufficiently large pool of European vendors capable of developing digital euro solutions. It had also shown that different types of architectural and technological design options were available to develop a technical solution for a digital euro. The prototyping project involved the integration of five user interfaces developed by different vendors for each use case (front-end prototypes) and a settlement system designed and developed by the Eurosystem (back-end prototype). Different design options were tested to determine whether they could be technically implemented and integrated into the Eurosystem's settlement system. The tests showed that it would be possible to integrate a digital euro smoothly into the existing payment landscape, while leaving room for the market to use innovative features and technologies in the dissemination of a digital euro. The results also confirmed that, in principle, a digital euro could function both online and offline using different technical concepts. The question remains whether an offline solution that meets the Eurosystem's requirements and achieves the necessary scale can be implemented in the short to medium term using existing technology.

On 18 October 2023 the ECB announced that a decision had been made to move forward with preparation phase, including a public pilot and aiming for a possible launch by 2025-2026.

= 2025

=On 31 January 2025, ECB President Cristine LaGarde and European Commission President Ursula von der Leyen published an op-ed in which they cited the digital euro project as part of an effort to keep Europe at the forefront of digital payment technologies.

Views on the possible introduction of a digital euro

The Governing Council will make a decision by the end of 2025 on whether to proceed to the next stage of planning for a digital euro.

The Verbraucherzentrale Bundesverband (Public German Consumer Protection Organisation) sees the digital euro as a public good and thus an opportunity to make digital payments more consumer-oriented.

The German Informatics Society (GI) sees the introduction of a digital euro and the simultaneous decline of cash as a threat to informational self-determination and privacy; there is a danger of the "Gläserner Mensch" (German metaphor for data protection, representing the complete "screening" of people and their behavior by a monitoring state, which is perceived as negative).

= German Banking industry

=From the perspective of the German Banking Industry Committee, the global trend toward central bank digital currency is unmistakable and represents both an opportunity and a challenge. The planned introduction of a digital euro is seen as an important contribution to the digitalization of the economy and society and to securing Europe's sovereignty and competitiveness. The digital money ecosystem proposed in a policy paper is intended to go beyond digital cash and consists of three elements:

Retail CBDC for personal use

Wholesale CBDC for banks and savings banks

Bank money tokens for industrial use

The Association of German Banks supports the introduction of a digital euro. In a position paper published in February 2023, the private banks emphasize the evolution of cash, their role in its issuance, its openness to innovation, and their desire to minimize the risks of its introduction. Among the risks, the private banks specifically mention those affecting their business (disintermediation, diminishing returns, weakening of their customer relationship) and that a weakening of their investment capabilities could lead to the failure of the digital euro.

The Bundesverband der Deutschen Volksbanken und Raiffeisenbanken (BdV) welcomes the ECB's plans for a digital euro, but criticizes that the needs of the economy for a future digital payment method have not yet been sufficiently taken into account.

= German Industrial sector

=In a position paper published at the end of September 2022, the Bundesverband der Deutschen Industrie (BDI, Federation of German Industries) warns that the needs of the industry must be taken into account when introducing a digital euro. The programmability of payments is a key demand.

= Eurogroup

=For Paschal Donohoe, president of the Eurogroup, a body of finance ministers from euro member states, the digital euro project is about maintaining the link between citizens and central bank money: as central bank money, the digital euro would be convertible one-to-one into euro banknotes.

Unlike the industry, the Eurogroup does not want the digital euro to be equipped with additional functions.

= European Commission

=The European Commission has submitted a legislative proposal for the introduction of a digital euro that should be made available as a legal tender not only to banks, but above all to the general public. Presented on 28 June 2023, this proposal outlines the fundamental requirements for its possible implementation. However, the final decision lies with EU member states and the European Parliament, who are currently —12 November 2024— negotiating this proposal. If the legislation is approved, the European Central Bank (ECB) will further develop the technical and operational aspects, aiming to create a secure and reliable digital euro, available alongside cash and traditional bank payment accounts.

Additionally, the proposal aims to protect user privacy, similar to cash, without extra oversight of individual transactions by the governments. For security purposes, there are considerations for limits on the amount individuals can hold in digital euros. All of this forms part of a preparatory phase that may take several years, with an expected implementation date from 2028 if the legislation is approved.

Further reading

Nicola Bilotta, Erwin Voloder: Going Global: The Political Ambition and Economic Reality of the (Digital) Euro, in: Nicola Bilotta, Fabrizio Botti (Hrsg.): Digitalization and Geopolitics: Catalytic Forces in the (Future) International Monetary System, Edizioni Nuova Cultura 2023, ISBN 978-8-83365-572-7.

Annelieke A. M. Mooij: A digital euro for everyone. Can the European System of Central Banks introduce general purpose CBDC as part of its economic mandate? In: Journal of Banking Regulation. 2022. doi:10.1057/s41261-021-00186-w

Annelieke A. M. Mooij: European Central Bank Digital Currency: the digital euro – What design of the digital euro is possible within the European Central Bank's legal framework? BRIDGE Network – Working Paper 14, May 2021.

Peter Bofinger: Grundzüge der Volkswirtschaftslehre. 5. edition. Pearson, Munich 2019, ISBN 978-3-86894-368-9, p. 561–578, Chapter 28: Digitalisierung des Geldes und die Zukunft der Geldpolitik.

Isabella Lindner: The Euro on its way to internationalization – Potential Geopolitical Impacts. In: Klemens H. Fischer (Publisher): European Security Put to the Test. Perspectives and Challenges for the Next Decade. (= AIES Beiträge zur Europa- und Sicherheitspolitik. Volume 6). Nomos Verlag, 2021, ISBN 978-3-8487-8558-2.

Thomas Mayer: A Digital Euro to Compete with Libra. In: The Economists' Voice. Volume 16, Issue 1, 2019.

Philipp Sandner, Jonas Groß: Der digitale Euro aus geopolitischer Perspektive. In: Johannes Beermann (Hrsg.): 20 Jahre Euro. Zur Zukunft unseres Geldes. Siedler, Munich 2022, ISBN 978-3-8275-0165-3, P. 409–436.

References

External links

Official website by the ECB

Human Rights Foundation CBDC tracker

Report on a digital euro, European Central Bank | Eurosystem October 2020

Bericht des Eurosystems über das öffentliche Konsultationsverfahren zu einem digitalen Euro, Europäische Zentralbank | Eurosystem April 2021

Friedrich Thießen: Digitaler Euro. Funktionsweise und kritische Würdigung, ZBW – Leibniz-Informationszentrum Wirtschaft 2021

Kommt der digitale Euro?, Bundesverband deutscher Banken, 18. August 2021

Europa braucht neues Geld – Das Ökosystem aus CBDC, Giralgeldtoken und Triggerlösung, Die deutsche Kreditwirtschaft, 5. Juli 2021

Heike Mai: Der digitale Euro. Politische Ambitionen treffen auf ökonomische Realitäten, Deutsche Bank Research, 2. Juli 2021

Auf einen Blick: Der digitale Euro, VÖB-Factsheet, 02/201

Der digitale, programmierbare Euro. Stellungnahme des FinTechRat beim Bundesministerium der Finanzen 01/2020 at the Wayback Machine (archived 2022-02-16)

Vormarsch des digitalen Euro?, Foresight und Technikfolgenabschätzung: Monitoring von Zukunftsthemen für das Österreichische Parlament, November 2021 Archived 2022-07-10 at the Wayback Machine

Philipp Sandner, Jonas Groß, Lena Grale: Der digitale Euro. Einfluss auf die deutsche Wirtschaft, Konrad-Adenauer-Stiftung e.V. 2021

Digitaler Euro auf der Blockchain. Infopapier, bitkom 2020

Markus Brunnermeier, Jean-Pierre Landau: The digital euro: policy implications and perspectives, Policy Department for Economic, Scientific and Quality of Life Policies Directorate-General for Internal Policies, January 2022

CBDC Manifesto, Digital Euro Association/CBDC ThinkTank, 2022-10-11

Kata Kunci Pencarian:

Digital Euro has potential to reduce payment costs, but concerns remain ...

THE DIGITAL EURO, OPERATIONAL CONSIDERATIONS – Garnatta Capital Markets

What is the Digital Euro?

European Central Bank confirms exploring digital Euro as retail ...

Digital euro – definition and benefits | BankingHub

Digital euro – definition and benefits | BankingHub

The Digital Euro | Seeking Alpha

Digital Euro Vector Art, Icons, and Graphics for Free Download

Digital euro won't support in-store retail payments in first release ...

ECB to discuss Digital Euro this week - Ledger Insights - blockchain ...

Eurosystem will decide on digital euro project by mid-2021 - Ledger ...

No Title

digital euro

Daftar Isi

EU unveils plans for digital euro, promising complete privacy

The European Commission has paved the way for the introduction of a digital euro. A total of 130 countries, representing 98% of global GDP are currently exploring central bank digital currencies. A global set of standards will help govern and streamline transactions worldwide as central banks prepare to launch digital currencies, the World ...

Tallinn tales: Estonia’s role in developing the digital euro

Nov 26, 2020 · This includes the European Central Bank (ECB), which will decide whether to give the green light to a digital currency by mid-2021. Olt, who worked at the ECB’s Frankfurt headquarters twice, strikes a similar tone. “I don’t think it’s a race but it seems we are steadily moving towards one [digital euro],” he says.

What is digital sovereignty and how are countries approaching it?

Jan 10, 2025 · Since then, the EU has established the Digital Markets Act (DMA), the Digital Services Act (DSA) and the Artificial Intelligence Act (AI Act), which collectively aim to regulate the digital economy and emerging technologies within the bloc.

Attack versus defence: central bank digital currencies and ...

Most nations are exploring the possibility of launching a central bank digital currency (CBDC) and a handful of CBDCs are already live. This Global Government Fintech webinar explored the cyber-risks. Central bank digital currencies (CBDCs) are an increasingly prominent topic for government authorities worldwide.

European Central Bank ponders digital currency launch

Nov 21, 2019 · The Berlin-headquartered Association of German Banks (Bundesverband deutscher Banken) published its position on digital currency at the end of October, calling for a ‘crypto-based digital Euro [to] be created’. The paper warns: ‘Europe must keep up with [the] competition so that the global financial architecture does not lead to a ...

Indian government to publish ‘health of civil services’ report

Mar 3, 2022 · The European Central Bank (ECB) has kicked off a tender process for design and business model consultancy for a potential digital euro. The procurement notice carries a total value of €20m (about US$22.1m) and is likely to have major companies scrambling to get directly involved with a potential European central bank digital currency (CBDC).

What's next for the US dollar? Economists discuss at Davos

Jan 23, 2025 · Jin Keyu, Professor, Hong Kong University of Science and Technology (centre) and Raghuram G. Rajan, Professor of Finance, University of Chicago Booth School of Business (left) were among leading economists that convened to discuss the world’s "love-hate relationship" with the US dollar at the World Economic Forum's Annual Meeting 2025 in Davos …

Central bank digital currencies: Here's the economic effects

Central banks around the world are exploring the case for central bank digital currency (CBDC) – essentially a digital version of cash (Nielpelt 2021). In a new paper (Ahnert et al. 2022a), we provide an overview of the economics of CBDC. First, we outline the economic forces that shape the rise of digital money and motivate the current debate.

Has China released a digital currency? | World Economic Forum

Sep 29, 2021 · While there was news about a digital euro in late 2020, the European Central Bank (ECB) didn’t take any practical steps until this year. In mid-July, the ECB announced the launch of the “investigation phase” of the digital euro project, which is expected to last for 2 years.

ECB launches SupTech procurement - Global Government Forum

Jan 21, 2021 · A detailed analysis will be published in the spring, ahead of decision on whether to launch the digital euro. The ECB said its initial analysis showed that privacy of payments ranked highest among the requested features of a potential digital euro (41% of replies), followed by security (17%) and pan-European reach (10%).